Como já tive contato com diversos outros livros e artigos sobre os temas acima, esta parte abaixo se torna uma boa liga - mastigável - para conectar com a linguagem dos empresários, tanto quanto aproximar a uma realidade que se torna cada vez mais forte de como se manter competitivo executando internamente os desired outcomes do cliente.

Sobretudo, analisar, mapear, criar e entregar experiências não apenas como parte tática de uma estratégia, mas que ela mais do que faça parte do core da empresa (que pode ser encarado como um to-do), seja parte do DNA dela. Ou seja, que haja, por causa de uma mudança de mentalidade dos empresários, de um shift sobre como as empresas enxergam o consumidor, tornando-o indivíduo.

Vale a leitura para entender como esta nova mentalidade de serviço modifica os modelos de negócios daqui pra frente.

More recently, the “customer experience” meme has been grabbing the attention of business leaders, marketers, and sales executives alike. The idea that “journey mapping” the customer’s experience or identifying “moments of truth” can improve loyalty and promote customer retention is everywhere these days. But is that really sufficient?

Businesses that sell to consumers—B2C companies like Walmart and Apple—have known this for a long time. By contrast, businesses that mainly sell to other businesses—B2Bs—have generally been slower to grasp this concept. Ostensibly, they’re all for pleasing customers, but they lack either the know-how or the inclination to change tried-and-true business models, preferring to tell customers something along the lines of “this is what we’re selling—take it or leave it.”

For these businesses, it has been mostly about closing the deal and moving to the next opportunity. Seldom do they try to find out whether the customer actually used what they had bought, whether it met expectations, or whether it actually contributed to a desired business outcome. More of these organizations are paying closer attention to customer satisfaction, loyalty, and customer experience, and many have made impressive strides in measuring and analyzing crucial points in the customer “lifecycle.”

They want to know what their customers think and feel about their products, and what the customer’s day-to-day experience is like. Many are investing heavily in systems to capture these insights. B2B economy and in the customer relationships that underpin it. Business buyers are behaving more like consumers: better educated from the flood of information available on the Web; empowered by the ruthlessly candid sharing of opinions on social media; and emboldened by the ease with which you can switch to the competition in what is called the Subscription Economy...an economy in which more and more products are designed to be consumed “as needed” or as a service and, moreover, sold not for their particular features and functions, but for the business outcomes they’ll deliver.

It’s no coincidence we’re seeing this first in the technology industry where “software as a service” has made deep inroads into businesses ranging...Under this scenario, your “sale” is no longer a one-time event but one of many interactions in which you engage in your customer’s business. This is a new kind of partnership that demands hyper vigilance if you hope to retain your customers long-term.

In the Subscription Economy, a big portion of the risk of not realizing full value from an investment shifts from the buyer to the seller, who must now think about the customer in a whole new way. Imagine knowing whether your customers are actually using your products, how often, and in what areas of their business. Furthermore, what if you knew whether they were getting maximum value out of them?

In the Subscription Economy, operationalizing these kinds of insights holds the potential to drive business value and radically transform customer relationships. Indeed, research firm Gartner has predicted that the Internet of Things market opportunity could be worth $1.9 trillion by 2020, a prediction that is looking to be right on track.

The ability to succeed in this new economy will depend on how well you sell and deliver measurable business outcomes to your customers. Are your customers truly benefiting from your products and services? Are you doing enough to ensure your customers are successful? Can you measure what success looks like for them?

The answers to these questions will be different for each company. Underneath these differences, however, is a set of core customer-centric principles and practices...These principles comprise a critical new capability we call “customer success delivery.”

Specifically, we define customer success delivery as a disciplined way of making your customers’ success and measurable business outcomes part of your corporate DNA.

COMO MANTER ISTO TUDO? DESENVOLVA UMA PLATAFORMA!

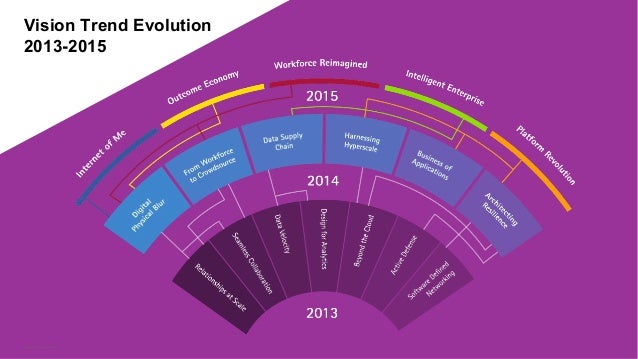

Numa camada um pouco mais complexa e que faz todo o sentido com o que este modelo de lidar com os consumidores do Hartman, está a Plataform Revolution. Que é justamente uma mudança mais profunda ainda em como as empresas devem criar os novos modelos de negócio, e não só adequar sua estratégia a um modelo servitizado.

Por que justamente é uma plataforma que será sua próxima arena de competição. Dando-lhe agilidade de entender, aprender e unir produtores, consumidores e diversos stakeholders gerando dados (big data) para melhorar sua análise e aprendizado competitivo.

É um modelo que te joga numa arena mais agressiva e que gira em torno de uma exigência mercadológica invisível chamada experiência e inter-relação de negócios, mesmo sendo ora competitivos ora necessário estar naquele jogo. Para isso é preciso ganhar o direito de competir, sendo o primeiro passo ser focado no consumidor. Como bem o domínio de novas competências, como UX por exemplo e Data Analytics.

"...platforms focus on growing the pie with others in their industry participating on them. Collaboration co-exists with competition. Today, Ford doesn’t simply have to worry about competing with Apple or Google, it has to also figure out how to participate in Apple’s ecosystem in some way so as not to be left behind like Nokia and Blackberry. Strategic considerations on recognising competition and their key source of competitive advantage aren’t straightforward anymore."Mas pensar em plataforma seria coisa só para startups?

Pense um pouquinho...

Leia isto:

- PEQUENAS EMPRESAS: "a mere 14 percent of our SMEs use the Internet as a sales channel today while this is widely the case for large companies. When it comes to using advanced digital technologies like robotics, data analytics or Cloud computing, the situation is much worse: only a tiny 1.7 percent of all EU enterprises use advanced digital tools to innovate in products and processes." https://ec.europa.eu/commission/2014-2019/oettinger/announcements/speech-hannover-messe-europes-future-digital_en

- GRANDES INDÚSTRIAS: The Industries That Are Being Disrupted the Most by Digital

- NO BRASIL: Brasileiro cria plataforma colaborativa de moda e desfila coleção em Lisboa

- NA EDUCAÇÃO: Google lançará plataforma de ensino colaborativo

- INDÚSTRIAS TRADICIONAIS: GE Digital Unveils Global Alliance Program, Forms New Collaborations on the Heels of Predix Platform General Availability, to Spur Industrial Internet Growt

fonte adicionais:

-ptgmedia.pearsoncmg.com/images/9780134172200/samplepages/9780134172200.pdf

-http://platformed.info/the-future-of-competition/

-http://pt.slideshare.net/accenture/tech-vision-trend-3-platform-revolution-slideshare-44659252

Nenhum comentário:

Postar um comentário